The abrupt policy shifts of the Trump administration have pushed the global hydrogen industry into a period of strategic restructuring. The cooling of the U.S. Hydrogen Hub initiative and the large-scale downsizing of corporate projects have unveiled the harsh reality of the competition between green and blue hydrogen pathways. As federal funding freezes and the tax incentives left by the Inflation Reduction Act create a counterbalance, the essence of this energy transition has evolved from a technological race to a contest of policy risk management capabilities.

Green Hydrogen or Blue Hydrogen? Blue hydrogen has gained favor due to its lower costs and mature technology, while green hydrogen faces challenges from policy uncertainties and market hurdles. Regional investment disparities are intensifying, with places like Texas and the Middle East emerging as new hotspots. Despite the difficulties, the industry should navigate these challenges through technological transitions and capital risk aversion.

1. Policy Shifts: The “Ice and Fire” of Hydrogen Under Federal Funding Freezes

The energy policy pivot in the Trump 2.0 era has sent ripples across the global hydrogen market, much like a stone thrown into a calm lake. As a major player in the global energy landscape, U.S. policy changes have significant implications for the hydrogen industry. The federal freeze on funding for clean energy projects has left the much-anticipated U.S. Hydrogen Hubs program in limbo.

Air Liquide’s participation in hydrogen hubs has been drastically reduced from six to two, while Air Products has outright canceled three clean energy projects.

These events mark a critical juncture for the global hydrogen industry, as companies face dual challenges of policy uncertainty and cost pressures, forcing them to reassess their strategies and make tough choices between green and blue hydrogen.

2. Survival Rules: Corporate Strategic Shifts and Hydrogen Pathway Restructuring

2.1 The Rise of Blue Hydrogen

Against the backdrop of the Trump administration tightening green subsidies, energy giants have demonstrated remarkable strategic flexibility. The $850 million blue hydrogen project by Air Liquide and ExxonMobil in Baytown, Texas, exemplifies a new development logic in the industry. By leveraging existing natural gas infrastructure, utilizing carbon capture and storage (CCUS) technology, and combining it with tax incentives, companies are able to quickly commercialize blue hydrogen. This “low-risk path” gives blue hydrogen a significant cost advantage, with costs only $1.5–2 per kilogram, about one-third of the cost of green hydrogen ($4–6 per kilogram). During times of policy uncertainty, blue hydrogen has become the preferred choice for companies due to its cost advantage and relatively mature technology.

2.2 The Strategic Retreat of Green Hydrogen

The cancellation of Air Products’ green liquid hydrogen project in Massena, New York, is a representative case. When federal tax credits (45V clause) failed to materialize due to regulatory disputes, coupled with a cooling hydrogen truck market and issues like Nikola’s bankruptcy and Hyzon’s cash flow crisis, green hydrogen projects relying on renewable energy electrolysis faced a double blow. Companies have had to adjust their strategies, turning their attention to regions like the Middle East’s NEOM, where policies are stable and renewable energy is cheap. This indicates that green hydrogen projects face numerous challenges in the current policy and market environment, necessitating more favorable development conditions.

3. Global Market Fragmentation: Regional Advantages Reshaping the Hydrogen Map

The “selective tightening” of Trump’s policies is reshaping the global hydrogen investment landscape.

3.1 The Texas Model

The Texas model, with its mature energy pipelines, streamlined approval processes, and residual tax incentives from the Inflation Reduction Act, has become a safe haven for blue hydrogen investments. The Baytown project’s modular air separation unit design, which allows for adjustments in response to policy fluctuations, highlights Texas’ advantages and flexibility in attracting hydrogen investments.

3.2 The New Battlefield of Regulatory Arbitrage

The emergence of regulatory arbitrage as a new battlefield is a significant trend in the global hydrogen market. Air Products’ shift to Louisiana’s clean energy complex and Saudi Arabia’s NEOM project shows that companies are seeking the “optimal solution” of policy stability and cost advantages globally. In a constantly shifting global energy landscape, companies are mitigating development risks by leveraging regional policy and cost benefits.

3.3 The Rise of Local Protectionism

The rise of local protectionism is another notable feature of the current hydrogen market. The competition among states for hydrogen hub projects suggests that future hydrogen development will rely more on regional policy alliances rather than federal coordination. This trend will lead to differentiated hydrogen industry development across regions and prompt stronger local policy-making and industrial planning to attract more hydrogen investments.

4. Long-Term Game: The Dialectics of Survival in the Hydrogen Industry

Despite the short-term pain, the hydrogen industry is not in full retreat.

4.1 The Theory of Technological Transition

From the perspective of technological transition, the temporary expansion of blue hydrogen buys time for green hydrogen to achieve technological breakthroughs. ExxonMobil’s modular carbon capture units are driving down CCUS costs, which will help reduce blue hydrogen production costs and provide a buffer for green hydrogen technology development. In the future, as green hydrogen technology matures, its costs are expected to decrease, giving it a more competitive edge in the market.

4.2 Capital Risk Aversion Strategies

Capital risk aversion is also a crucial strategy for companies in the current environment. By forming equity partnerships, such as Air Products bringing in strategic investors, companies can reduce capital expenditures by 40% to 60%, maintaining technological reserves while controlling risks. This strategy allows companies to sustain development amid policy and market uncertainties and prepare for future technological breakthroughs and market expansions.

4.3 The Awakening of Demand

The awakening of demand is a key driver for the long-term development of the hydrogen industry. Although the transportation sector is currently facing setbacks, decarbonization demands in industries like steel and chemicals continue to grow. Mechanisms like the EU’s Carbon Border Adjustment Mechanism (CBAM) are creating new market pull, offering more opportunities for hydrogen applications in industrial sectors. As global attention to climate change increases, industrial demand for clean energy will become a significant pillar for hydrogen industry growth.

5. The Path to Breakthrough: MINNUO‘s Global Hydrogen Infrastructure Solutions

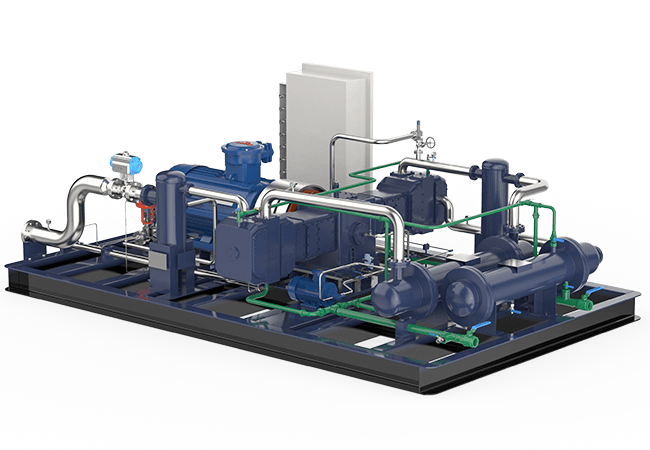

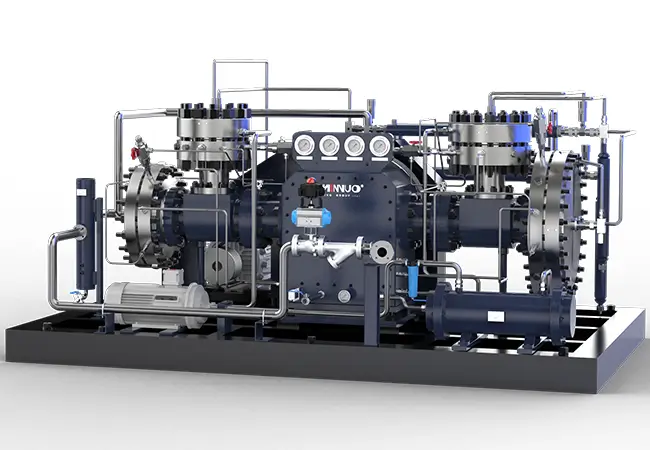

In this global hydrogen upheaval, MINNUO’s hydrogen refueling stations offer unparalleled competitive advantages.

5.1 Technical Adaptability

Technical adaptability is a major strength of MINNUO’s hydrogen refueling stations. Our modular design is compatible with both green and blue hydrogen refueling, allowing customers to quickly switch hydrogen production pathways based on regional energy structures. This flexibility enables MINNUO stations to adapt to different regional energy characteristics and market demands, providing users with more convenient and efficient services.

5.2 Investment Risk Aversion Model

The investment risk aversion model is another key competitive edge of MINNUO’s hydrogen refueling stations. Our distributed, small-scale hydrogen refueling network reduces policy risks, and the dynamic capital allocation system helps customers navigate subsidy fluctuations. This approach ensures stable operations for customers in an unstable policy environment.

Currently, MINNUO is collaborating with international partners to develop a “Hydrogen Resilience Index” assessment system, helping investors identify low-risk, high-return projects in an uncertain policy environment. Just as Air Liquide demonstrated survival wisdom in the Baytown project, building resilience to navigate changes is more crucial than choosing between colors in the marathon of the hydrogen revolution. MINNUO is becoming an infrastructure enabler in this endurance race, providing solid support for the global hydrogen industry’s development.

6. Conclusion

In the global upheaval of the hydrogen industry, MINNUO’s modular hydrogen refueling stations, with their technical adaptability and investment risk aversion models, have built infrastructure resilience to withstand cyclical challenges. The blue hydrogen breakthrough in Texas and the green hydrogen expedition in the Middle East both underscore that the key to winning the energy transition lies in balancing policy fluctuations and technological iterations. As the “Hydrogen Resilience Index” becomes the new benchmark, the color debate will ultimately give way to a long-term game of systemic empowerment.

Choosing MINNUO is choosing the future!

Email

Email sales:+86 15366749631

sales:+86 15366749631