Driven by the dual impetus of the “dual carbon” goal and new energy efficiency standards, China’s air compressor industry is experiencing an unprecedented wave of consolidation. Leading enterprises are aggressively expanding their market share by leveraging advantages in technological R&D, economies of scale, and capital, resulting in frequent mergers and acquisitions. In contrast, a large number of small and medium-sized brands (SMBs) are trapped in a triple predicament of “soaring costs, lost orders, and compressed profits”. However, industry consolidation is not a zero-sum game of “the big fish eating the small fish”. If SMBs can accurately position themselves and leverage their strengths, they can still carve out a niche in segmented markets and achieve a counter-trend breakthrough.

Intensified Industry Consolidation: Sources of Survival Pressure for SMBs

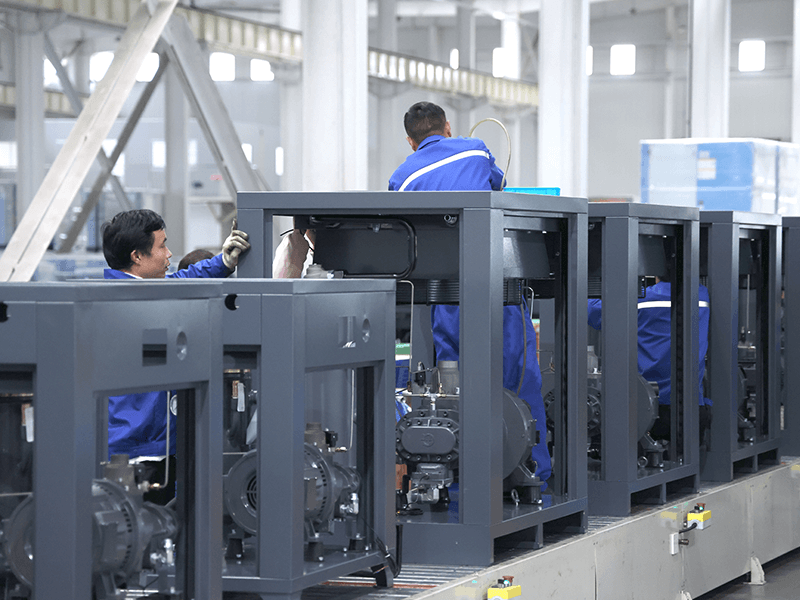

The current wave of consolidation in the air compressor industry is essentially a market-driven necessity for “clearing inefficient production capacity and concentrating high-efficiency resources”. Multiple underlying factors have collectively created survival pressure for SMBs.

Policy guidance serves as the “catalyst” for consolidation. The newly implemented Energy Efficiency Limits and Energy Efficiency Levels for Positive Displacement Air Compressors (GB19153-2024) in 2024 has significantly raised the energy efficiency threshold for air compressors, directly pushing a batch of technologically backward and energy-inefficient SMBs to the brink of elimination. Meanwhile, local environmental protection policies have tightened controls on high-pollution and high-energy-consumption production links. If SMBs cannot afford the costs of upgrading environmental protection equipment, they will lose their production qualifications. In contrast, leading enterprises have inherent advantages in policy compliance due to their early deployment of energy-saving technologies and sound environmental protection systems, further squeezing the market space for SMBs.

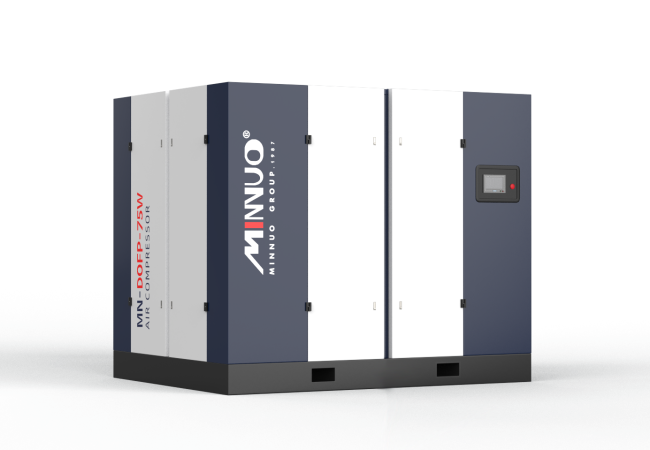

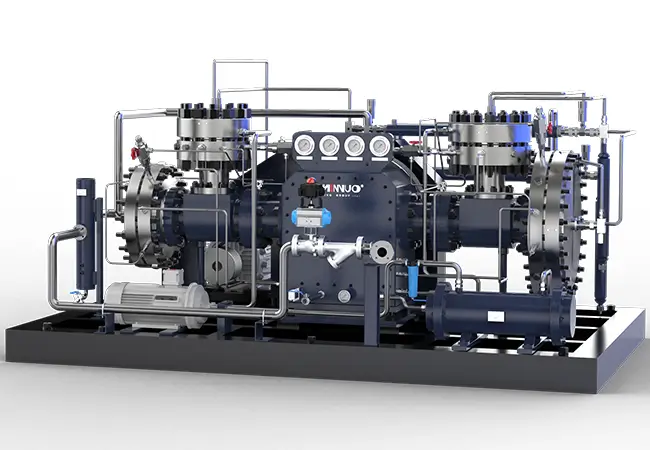

The upgrading of market demand acts as the “baton” for consolidation. As the manufacturing industry moves toward high-endization and intelligence, high-end fields such as electronics, medical care, and semiconductors have put forward strict requirements for the “purity” and “stability” of compressed air, leading to a surge in demand for high-end products such as CLASS 0 oil-free air compressors and intelligent frequency conversion air compressors. These products require long-term technological accumulation and substantial R&D investment. Due to insufficient R&D capabilities, SMBs often struggle to meet such demands and are forced to retreat to the low-value-added general-purpose market. Leading enterprises, however, continue to seize the high-end market through technological iteration, continuously narrowing the survival radius of SMBs.

Cost and capital pressures serve as the “ballast stone” for consolidation. The prices of core raw materials for air compressor production, such as steel, motors, and frequency converters, fluctuate significantly. Leading enterprises can secure stable cost advantages through large-scale procurement and long-term supply chain cooperation. In contrast, SMBs have small procurement volumes and weak bargaining power, resulting in raw material costs that are 10%-15% higher than those of leading enterprises. Additionally, SMBs face narrow financing channels, which restrict their capital investment in technological R&D, market expansion, and equipment upgrading, making it difficult for them to build sustainable market competitiveness.

Breakthrough Paths: Differentiated Survival Strategies for SMBs

Facing the pressure of industry consolidation, SMBs do not need to blindly engage in “head-on competition” with leading enterprises. Instead, they should rely on their advantages of flexibility and proximity to the market to build core competitiveness from the dimensions of segmented markets, technological cooperation, and service upgrading, thereby forging a differentiated breakthrough path.

Focus on Segmented Scenarios and Build Differentiated Products

Leading enterprises often pursue “comprehensive and large-scale” product portfolios, making it difficult for them to meet the personalized needs of all segmented scenarios—and this is precisely the opportunity for SMBs. SMBs can focus on a specific vertical field, delve into scenario-based demands, and develop “specialized and refined” products with unique features. For example, in mobile operation scenarios such as mining and infrastructure construction, higher requirements are placed on the “portability” and “ability to withstand harsh environments” of air compressors. SMBs can develop lightweight, high-protection-level mobile air compressors tailored to these needs, optimizing the body structure and power system to meet the special requirements of outdoor operations. In fields with concentrated small and micro enterprises, such as food processing and small-scale pharmaceutical production, SMBs can launch cost-effective small oil-free air compressors, simplifying functional design to control production costs while ensuring compliance with industry hygiene standards.

A small and medium-sized air compressor enterprise in Zhejiang achieved a breakthrough by focusing on the agricultural planting scenario. Targeting the air demand of irrigation and ventilation equipment in greenhouse cultivation, it developed a small low-noise frequency conversion air compressor. Not only did this product reduce energy consumption by 20% compared with similar products, but it also featured a simple operation panel and remote start-stop function, accurately matching the usage habits of farmers. Eventually, it captured over 30% of the agricultural market in East China.

Leverage Technological Cooperation to Make Up for R&D Shortcomings

Technological R&D is a core shortcoming for SMBs, but they do not need to work in isolation. SMBs can quickly acquire technological resources and reduce R&D costs through “industry-university-research cooperation” and “supporting cooperation with leading enterprises”. On one hand, they can establish cooperative relationships with local universities and research institutions to jointly carry out targeted technological research. For example, they can jointly develop energy-saving motors and simple intelligent control systems suitable for SMB production lines, leveraging the technological reserves of research institutions to shorten the R&D cycle. On the other hand, they can become supporting suppliers for leading enterprises, providing services such as processing specific components and OEM production of segmented models. Through such cooperation, they can learn the technical standards and production management experience of leading enterprises, gradually improving their own technical capabilities.

A small and medium-sized air compressor enterprise in Guangdong collaborated with a local university of science and technology to jointly develop a simple IoT-based equipment monitoring module. By only installing low-cost sensors and simple data transmission units, this module can realize real-time monitoring of air compressor operating status and fault early warning, with a cost less than one-third of that of high-end intelligent modules. This technology is not only applied to the enterprise’s own products but also purchased by many peer enterprises, becoming a new profit growth point.

Upgrade Localized Services to Build Customer Stickiness

As the “power core” of industrial production, the operation and maintenance services of air compressors directly affect the production efficiency of enterprises. While the service networks of leading enterprises are widely covered, they often lack in-depth penetration at the local level. SMBs can rely on their localized advantages to build a service system characterized by “rapid response and precise service”, thereby establishing differentiated competitiveness. For example, they can set up a 24-hour local service hotline to ensure on-site service within 4 hours after a fault report. They can launch “customized maintenance packages” for local customers, formulating personalized maintenance plans based on the customers’ equipment usage frequency and working conditions, and providing regular on-site equipment inspections and spare parts replacement services. Additionally, they can offer free energy consumption diagnosis services for customers, optimizing the compressed air system in combination with their own product advantages to reduce the customers’ energy costs.

A regional air compressor brand in Jiangsu consolidated its market position through a “service + product” model. It established 12 service outlets in the province and launched an “equipment leasing + integrated maintenance” service targeting local manufacturing clusters. Customers do not need to bear the equipment procurement cost and only pay according to air consumption, while the enterprise secures stable revenue through long-term maintenance services. This model not only lowers the cooperation threshold for customers but also achieves long-term binding with them.

Embrace Digital Tools to Improve Operational Efficiency

Digital transformation is not exclusive to leading enterprises. SMBs can optimize the efficiency of production, sales, management, and other links, and reduce operational costs by introducing low-cost digital tools. In the production link, small ERP systems can be adopted to realize digital management of raw material procurement, production progress, and inventory, avoiding inventory backlogs and production disconnections. In the sales link, online marketing can be carried out through short video platforms and industry vertical e-commerce channels, accurately reaching target customers by displaying product test videos and customer cases, thereby reducing offline promotion costs. In the management link, online collaboration tools can be used to optimize internal communication processes and improve team work efficiency.

Conclusion: Seeking New Opportunities Amidst Consolidation

The consolidation process of the air compressor industry is both a process of eliminating inefficient production capacity and a process of reconstructing the industry ecosystem. For SMBs, industry consolidation is not a “doomsday” but an “opportunity” for transformation and upgrading. By abandoning the illusion of pursuing “comprehensive and large-scale” operations, focusing on the positioning of “specialized and refined”, and leveraging segmented scenarios, technological cooperation, localized service upgrades, and digital transformation, SMBs can not only gain a firm foothold amid industry consolidation but also become “hidden champions” in segmented fields. In the future, with the continuous upgrading of the manufacturing industry and the continuous release of demands in segmented markets, those SMBs that can accurately grasp demands and respond quickly to the market will surely occupy a place in the new ecosystem of the air compressor industry.

Email

Email sales:+86 15366749631

sales:+86 15366749631